1. They Use AI-Powered Budgeting Apps to Control Spending Automatically

Unlike previous generations who used spreadsheets or manual budget tracking, Gen Z leans into smart apps that do the work for them. Apps like Cleo, Monarch, and Plum use AI to track spending behavior, predict upcoming bills, and even shame or praise users to encourage better habits.

How it works:

AI categorizes purchases, detects subscriptions, predicts overdrafts, and suggests savings strategies. Some apps even chat with users in a conversational tone (like Cleo) to make finance feel more like texting a friend than managing money.

Result:

Gen Z stays financially aware and avoids overdrafts or unnecessary spending without having to manually manage everything.

2. They Invest Using Robo-Advisors and AI-Based Portfolio Managers

Gen Z doesn’t trust traditional financial advisors as much as they trust tech. Apps like Wealthfront, Betterment, Acorns, and SoFi use AI to create personalized portfolios based on a user’s goals, risk tolerance, and even social values (like sustainable investing).

How it works:

The AI monitors market shifts, rebalances portfolios, and auto-invests extra cash. Fractional shares let Gen Z invest small amounts consistently—even $5 at a time.

Result:

Even without financial education, Gen Z builds diversified, optimized investment portfolios with minimal effort and strong returns over time.

3. They Automate Savings with AI ‘Round-Up’ Tools and Micro-Saving Bots

Saving is often hard when income is inconsistent (like with side hustles), so Gen Z automates it. AI tools like Qapital, Chime, and Digit round up purchases or analyze income/spending to pull small amounts into savings or emergency funds without users noticing.

How it works:

Buy a $3.60 coffee? The app rounds up to $4 and puts $0.40 into savings. Spend more than usual? The AI adapts and saves less that week.

Result:

Gen Z builds emergency savings and travel funds without “feeling” the loss, turning passive transactions into active financial growth.

4. They Build and Run Side Hustles Entirely with AI Tools

Gen Z is entrepreneurial, but they don’t need a team. They use AI to start and scale one-person businesses:

- ChatGPT for writing content, emails, or business ideas

- Canva with AI for creating logos and social media graphics

- Durable.co or Framer AI to build instant websites

- Pictory or Descript for video editing and voiceovers

How it works:

Instead of hiring freelancers or learning every skill manually, Gen Z inputs prompts and gets usable business assets in minutes.

Result:

They launch freelancing, digital product stores, YouTube channels, and newsletters solo—with the power of AI as their team.

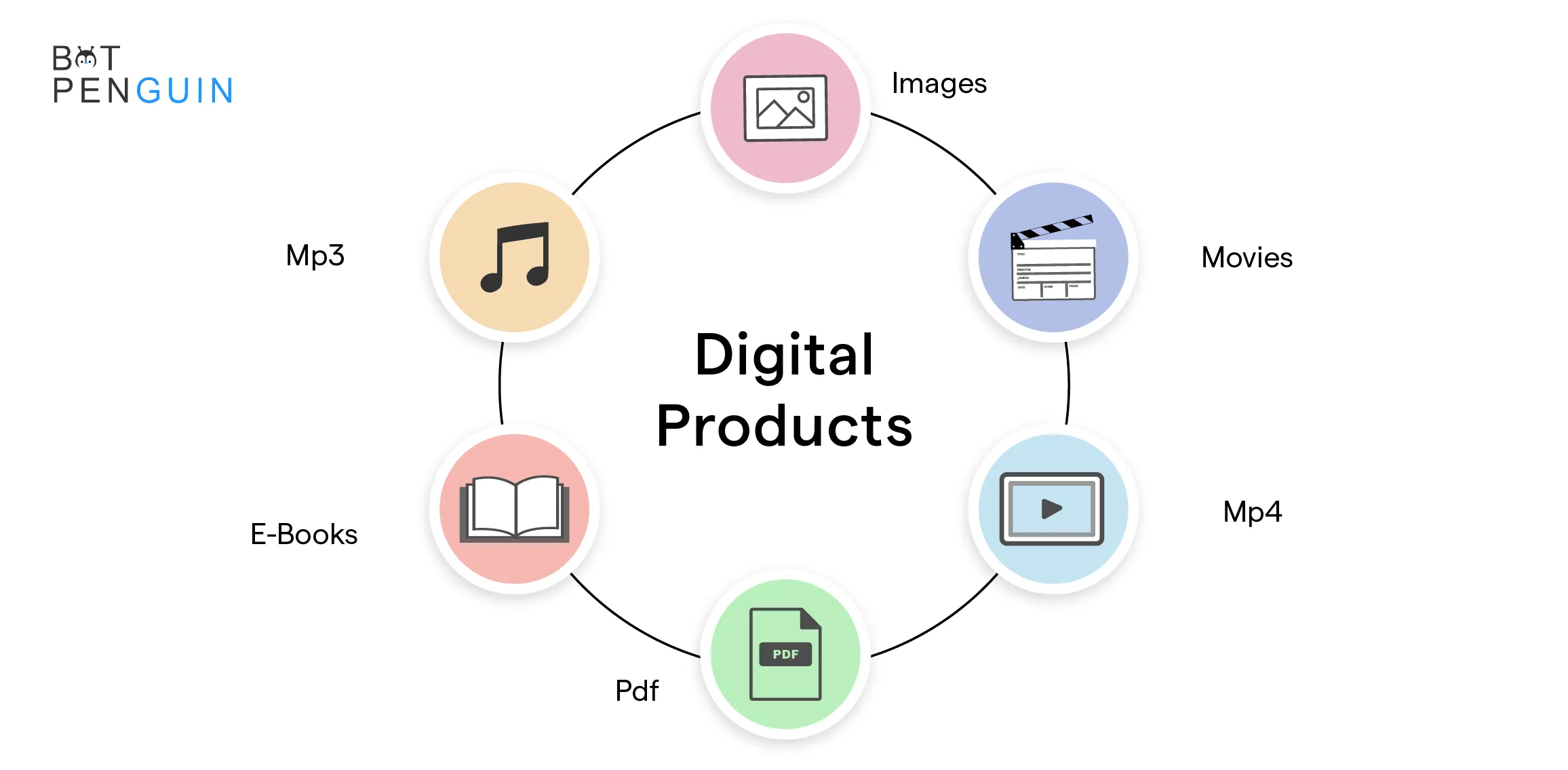

5. They Sell Digital Products or Content Created with Generative AI

Gen Z taps into platforms like Etsy, Gumroad, Amazon KDP, and Redbubble to sell AI-generated products:

- Ebooks made with ChatGPT

- AI art printed on clothing

- Notion templates and planners

- Midjourney-designed posters or wallpapers

How it works:

They generate, package, and list products—all with AI—and market them on TikTok or Instagram using AI-made content.

Result:

They create passive income streams by scaling product creation and promotion faster than ever.

6. They Use AI to Analyse Market Trends and Make Smarter Business Moves

Tools like Exploding Topics, Trends.vc, and Google Bard help Gen Z track emerging niches, SEO keywords, and viral product ideas. AI helps analyze trends on social media, Amazon, and YouTube before they explode.

How it works:

Rather than guessing what will sell, Gen Z uses AI to scan data and identify fast-moving opportunities—then creates content or products to match.

Result:

They launch trending side hustles with precise timing, often going viral or generating fast sales with minimal testing.

7. They Learn Finance via AI-Curated TikToks, YouTube Shorts, and Bots

Forget finance textbooks—Gen Z prefers learning through bite-sized AI-curated content on platforms like TikTok and YouTube. AI helps these platforms show relevant content (e.g., investing tips, side hustle tutorials, crypto how-tos) based on user behavior.

How it works:

The more Gen Z engages with personal finance videos, the more AI feeds them optimized content to learn faster. Some even use AI-powered bots in Discord servers to answer financial questions in real-time.

Result:

They receive personalized financial education 24/7, without needing to read a single traditional finance book.

8. They Trade Crypto and Stocks Using AI Bots and Signals

While the hype around crypto has cooled, Gen Z is still active—and smarter. They use AI trading bots on platforms like Pionex, 3Commas, and Bitsgap to execute trades based on algorithms rather than emotions.

How it works:

These bots buy/sell based on trends, price movements, or AI-generated forecasts. They also follow “copy trading” features to mimic successful traders.

Result:

Gen Z can automate investing and crypto trading, avoiding emotional mistakes and trading while they sleep.

9. They Monetize Their Personal Brands with AI Automation

Gen Z turns their online presence into income by combining social media with AI tools. Examples:

- AI-generated Instagram carousels for affiliate marketing

- TikTok scripts written by ChatGPT for educational or viral content

- Email newsletters written, formatted, and sent using AI (via Beehiiv or ConvertKit + ChatGPT)

- Content scheduling with AI tools like Later or Buffer with predictive engagement features

How it works:

They create once, schedule forever, and use AI to multiply their reach—without spending hours every day online.

Result:

They grow audiences and earn affiliate income, sponsorships, or course sales automatically.

10. They Create “Money Systems” Powered by AI — Not Just One-Time Hacks

Most importantly, Gen Z doesn’t just look for hacks—they build systems. With AI as the engine, they automate:

- Budgeting and bill payments

- Investing and portfolio management

- Income streams through scalable products or services

- Marketing and analytics

- Learning and trend tracking

How it works:

They combine tools like Zapier, Notion AI, and automation APIs to create connected workflows that run their finances and businesses for them.

Result:

Their financial life becomes mostly passive, allowing them to focus on creativity, learning, or scaling further.

Final Thought:

Gen Z isn’t waiting for financial stability—they’re building it with tech, speed, and creativity. AI gives them the tools, and side hustles give them the income diversity. This generation isn’t playing the old financial game. They’re rewriting the rules.

Leave a Reply